Owner-occupier lending bounces back from five-month slump

- February 15, 2022

- Posted by: admin

- Category: house

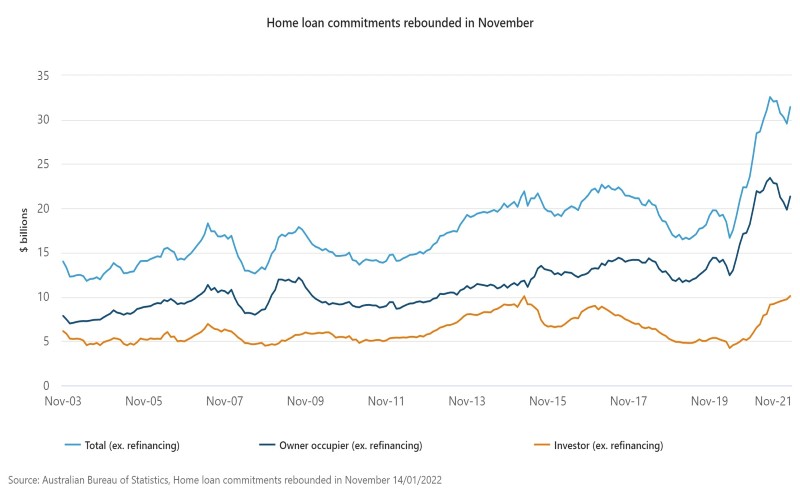

Australian home loan borrowers came rushing back in November last year, driving a rebound in overall value of new loan commitments for housing.

Figures from the Australian Bureau of Statistics (ABS) showed a 6.3% growth in the value of new housing loan commitments (excluding refinancing) to $31.4bn.

The value of owner-occupier housing recovered strongly, ending the five-month period of declines with a growth of 7.6%.

This recent gain in owner-occupier financing was the first increase since May 2021 and the largest since January 2021.

BIS Oxford Economics senior economist Maree Kilroy said two states led the rebound in home loan activity among owner-occupiers over the month.

“Coming out of lockdowns, pent up demand to transact saw owner-occupier loans rebound solidly in New South Wales (up 9.6%) and Victoria (up 9.7%) which drove much of the national result,” she said.

Busy month for first-home buyers, investors

The first-home buyer segment also reported gains in the month, breaking the downtrend that started in January 2021.

Over the month, the number of new loan commitments to first-time buyers rose by 1.9%. On an annual basis, however, activity was down 17.4%.

Victorian first-home buyers were the most active, reporting a 12.3% growth in the month. Increases were also seen in New South Wales and Western Australia.

ABS head of finance and wealth Katherine Keenan said investors continued to widen their share in the market.

“Activity in the investor market was also strong. The value of new loan commitments to investors rose 3.8% reaching a new all-time high of $10.1bn,” she said.

Investor lending has already grown for the past 13 months, accounting for around a third of the value of new housing loan commitments.

“The previous investor lending peak in April 2015 accounted for 46% of new housing loan commitments,” Ms Keenan said.

Bluestone Home Loans consultant economist Dr Andrew Wilson said despite the gains in lending activity, recent factors, including the latest COVID variant, could potentially impact the performance of the lending market in the coming months.

“The outlook clearly remains mixed with affordability barriers, the satisfaction of pent-up demand, and uncertainty – and the reimposition of restrictions – regarding the current severe coronavirus outbreak, set to reduce home buying activity over coming months,” he said.