RBA warns of 2024 interest rate rise

- November 17, 2023

- Posted by: admin

- Categories:

The Reserve Bank of Australia (RBA) has warned of another possible increase to the official cash rate (OCR) in its quarterly Statement on Monetary Policy.

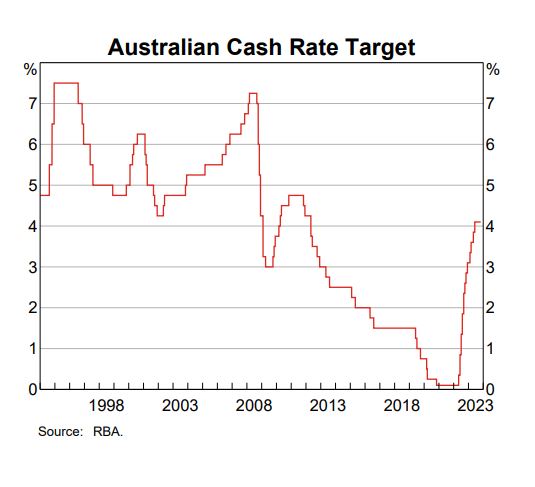

Following the increase in the cash rate target by 25 basis points to 4.35% in November, the RBA said market pricing implied an “expectation that the cash rate may be increased once more in the first part of 2024”.

“The weight of recent information suggests that the risk of inflation remaining higher for longer has increased,” said the statement, which is the RBA’s assessment of current economic conditions.

The updated forecasts have inflation in Australia higher in the near term and taking a bit longer to return to the top of the bank’s target range, according to the Reserve Bank, led by governor Michele Bullock (pictured above).

“The forecasts assume a path for the cash rate that is in line with financial market pricing and market economist expectations, and therefore incorporate some increase in the cash rate,” the RBA board said in its Statement on Monetary Policy.

Signs point to 2024 RBA cash rate hike

One measure the RBA used to gauge the market’s expectations for the path of the cash rate was the overnight index swaps (OIS) – a financial instrument used to determine interest rates.

The OIS rate has increased in recent months and particularly rose in response to the release of the minutes of the RBA’s October Board meeting.

The RBA said the minutes were interpreted as being “somewhat hawkish” by the market following the higher-than-expected inflation data.

“This is consistent with views of market economists. Moreover, compared with a few months ago, market participants expect the cash rate to remain around its peak for longer,” the RBA said.

RBA: Inflation persists

The RBA also said there was potential for further upside surprises to inflation.

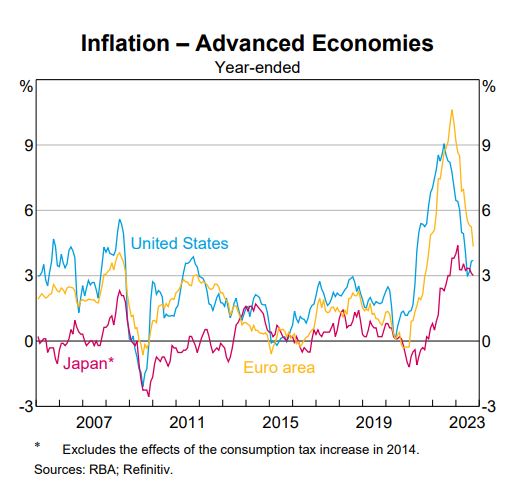

Persistently high inflation remains the major concern for central banks in advanced economies internationally.

The RBA said headline inflation has edged higher over recent months because of increases in fuel prices.

“Core inflation has continued to decline in year-ended terms, but progress has been gradual because core services inflation has been declining only slowly as demand for services has been relatively strong and labour markets have remained tight,” said the central bank.

According to the RBA, the risk that inflation takes even longer to return to target has increased.

“Domestic inflationary pressures are persisting and because of external factors, such as potential global energy market disruptions and the prospect of higher food price inflation related to El Niño.”

RBA Board mindful of painful budget squeeze

Some of the earlier tightening in monetary policy is still working its way through the economy.

Scheduled mortgage payments have increased in recent months and the RBA said it would rise somewhat further as borrowers with very low fixed rate loans roll off onto higher mortgage rates.

However, the Reserve Bank expects the number of borrowers still rolling off low fixed-rates to ease in the second half of 2024.

The RBA Board was also mindful that many households are facing “a painful squeeze on their budgets”, both from high inflation and the increase in mortgage rates to date.

“There are also economic and social benefits in preserving as much of the gains in the labour market as possible,” the RBA’ said in its statement.

“Weighing all these considerations, the Board judged that, after holding policy rates steady for the past few months, it was appropriate to raise rates at the November meeting.”

Resource: brokernews.com.au