How a likely rate hike would impact repayments

- April 20, 2022

- Posted by: admin

- Categories:

Households who experience a proportional pay rise might not feel a significant impact from the rate hike

A little over a month from now, the Reserve Bank of Australia could potentially make its first rate hike, which would likely prompt lenders to raise their variable rates – so how will this affect an average borrower’s repayments?

According to a report from Savvy, repayments could potentially increase by around 2.8% p.a. if variable rates go up by 15 basis points.

This is based on a home loan of $500,000 over a 25-year term with a variable interest rate of 2.7% p.a. (average as of December 2021) for a household income of around $135,720.

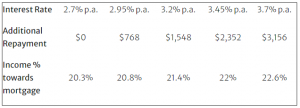

Here’s a table showing how much repayments would increase after each succeeding 25bps hike in variable rates. Take note that the figures below assumes that the lenders will pass on the full central bank rate hike to their borrowers.

![]()

The increase in repayments may not be a big problem as it seems, if wages rise in proportion with inflation.

If households experience a 1% p.a. increase in interest rates, they will need to come up with around $35 per year to accommodate the increase in rates — this is assuming that they also experience a wage growth of 2.3% (based on the Australian Bureau of Statistics Wage Price Index – December 2021).

However, households who do not get a pay increase would need to come up with the following amounts over the year to meet the higher repayments:

Under this scenario, households who end up being on single incomes or experience job loss would immediately be in mortgage stress.

Savvy CEO Bill Tsouvalas said around 584,000 mortgage holders were at risk of mortgage stress at the end of 2021, which is near record low.

“This is after numerous government interventions such as extended payment holidays, JobKeeper/JobSeeker, COVID Disaster Payments, and so on,” he said.

“What is pleasing to note is that unemployment is at near-record lows at 4%, which should push wages higher, especially in services where employers are scrambling to fill positions.”

Mr Tsouvalas said this could be a good time to fix your rate, given the likelihood of further rate hikes over the coming months.

“Refinancing at a lower rate is also better to start sooner rather than later, because with all indicators pointing to rising inflation, rates will definitely start shifting upwards,” he said.

Resource: yourmortgage.com.au