RBA holds cash rate at 4.35%: When will borrowers get a break?

- November 13, 2024

- Posted by: admin

- Categories:

The Reserve Bank of Australia (RBA) board has kept the cash rate on ice as anticipation for a long-awaited cut continues to build.

Easing inflation may have lifted the hopes of embattled borrowers, but the RBA signalled it hasn’t yet seen enough to begin reducing interest rates on Tuesday.

The decision leaves the cash rate – a major influence on home loan interest rates – at a 13-year high as the holiday season approaches, likely heightening financial stress for many cash-strapped homeowners navigating high mortgage repayments.

“While headline inflation has declined substantially and will remain lower for a time, underlying inflation is more indicative of inflation momentum, and it remains too high,” the central bank said in a statement.

“Policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range.”

RBA governor Michele Bullock will front the press at 3:30pm AEDT to provide further insights into the board’s decision.

Until recently, experts were signalling a November rate cut, but continuously strong economic data, particularly surrounding the jobs market, largely stifled such speculation.

CommBank pushed its forecast for the first cash rate cut back by one month to December just six weeks ago, and pushed it back once more to February soon after.

On a brighter note, NAB brought its forecast forward to February, earlier than its previous prediction of May, perhaps indicating rising confidence in a near-term cut.

“Slowing employment and inflation may prompt rate cuts from February 2025, but the resilient labour market and stickier components of inflation could delay this timeline,” REA group senior economist Eleanor Creagh said.

When will the RBA cut the cash rate?

Headline inflation appeared to cool in the September quarter, but underlying inflation – which excludes the volatile prices like those of fuel and energy – remains above the RBA’s target of 2% to 3% on an annual basis.

The Australian Bureau of Statistics (ABS) will publish the next quarterly inflation read in late January, just weeks out from the RBA board’s February meeting.

The central bank’s latest forecasts tip the measure to fall in the December quarter, but only to 3.4% on an annual basis.

Underlying inflation is expected to have dropped to 3% by mid-2025 and to 2.8% by December 2025.

What would a cash rate cut mean for home loan interest rates?

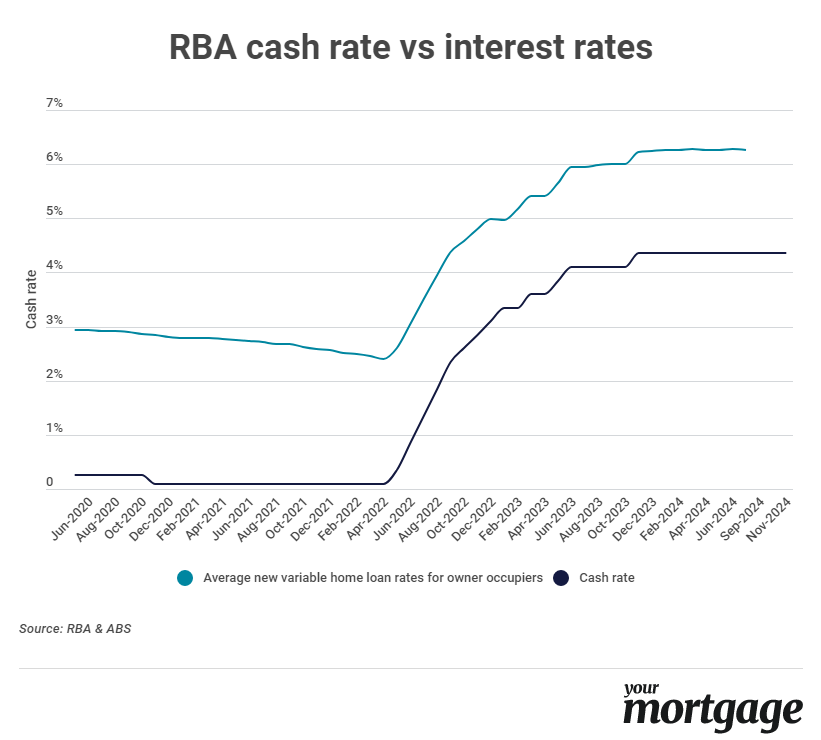

The typical interest rate on a new, variable rate owner-occupier home loan has roared from a low of 2.40% p.a. in early 2022 to approximately 6.30% p.a. in 2024.

Such a rise would push monthly repayments on a $500,000, 30-year mortgage from approximately $1,950 to close to $3,100 – a difference of nearly $13,750 a year.

While it’s unlikely the RBA board will cut the cash rate to its record low of 0.1%, even a modest cut, if passed onto borrowers, could bring some relief to struggling home loan holders.

For example, if the RBA cuts the cash rate by 25 basis points and lenders pass that cut on in full, the typical new variable rate for owner-occupiers could drop to 6.05% p.a.

Such a shift would save a borrower with a $500,000, 30-year mortgage about $80 per month or over $970 annually.

A larger cut of 50 basis points could save this borrower more than $1,900 a year which, for the average wage earner, represents a greater annual impact than this year’s stage three tax cuts.

Resource: yourmortgage.com.au